Greece and the 10th anniversary of the global financial crisis

We are at the 10th anniversary of the global financial crisis that laid ruin to the Greek economy. The overriding lesson of the global crisis is the persistently weak governance of the global financial system. I count six basic blunders that cost the world trillions of dollars in lost output and years of anguish. Unfortunately, among the worst blunders has been the handling of the Greek crisis, including the recent empty declarations that the crisis is over. If only life were as easy as the fantasies of the politicians and of European Union bureaucrats who routinely checked the boxes.

Blunder 1. Excessive liquidity and financial deregulation (pre-2008). At the core of the 2008 financial crisis was a major expansion of credit that greatly outpaced the real economy during the years 2001-2007. With Wall Street’s political power ascendant in the Clinton Administration during 1993-2000, the US government deregulated Wall Street in the late 1990s and the Federal Reserve pumped credits into the deregulated banking system in the early 2000s. The result was a housing bubble and leveraged balance sheets of America’s major financial companies (including commercial banks, investment banks, and insurance companies).

Blunder 2. Financial panic resulting from the Lehman bankruptcy (September 2008). The lending boom came to an end by mid-2007 and many banks faced financial distress as borrowers could not repay their mortgages and consumer loans. The US Treasury secretary at the time, Hank Paulson, then triggered a global financial panic in September 2008 by forcing Lehman Brothers into bankruptcy, the single most costly financial policy blunder since the Great Depression. By abruptly closing Lehman Brothers, Paulson turned a credit squeeze into a financial panic.

Blunder 3. Europe’s delay in addressing the financial panic. With the onset of financial panic, normal interbank liquidity ceased. Firms, even major ones, could not get working capital. Output collapsed. It was the job of the European Central Bank to provide liquidity as the Lender of Last Resort (LLR). Alas, major German policymakers such as Jens Weidmann, formerly senior advisor to Chancellor Angela Merkel and president of the Bundesbank since May 2011, were against the ECB acting as the LLR and pressured the ECB to keep credit tight. Only with the arrival of Mario Draghi at the ECB helm in November 2011 was Weidmann effectively overruled.

Blunder 4. Failure to revive Greece’s bank lending. Europe treated Greece’s crisis almost entirely as a crisis of fiscal (budget) policy, neglecting the collapse of liquidity in the Greek economy. Greece suffered a catastrophic collapse of bank lending that in turn crushed the private sector. The series of bailouts did almost nothing to revive Greece’s bank lending. Indeed, the ECB effectively closed the banking sector in June-July 2015 around the time of the referendum, in what looked to me like a punitive attack by European governments and institutions on Greece’s negotiating position that called for long-term debt relief.

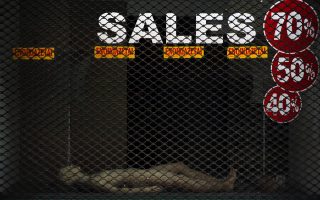

Blunder 5. Kicking the can down the road. The government of Greece fell into insolvency in 2009 when it could not routinely roll over its debts. By the early 2010s it became clear that Greece’s debts were so large relative to GDP that Greece would need a long-term reduction of its debt-servicing burden to re-establish creditworthiness. Until today, including the June 2018 package of measures to “end” the Greek crisis, the creditors have relied excessively on making new loans to Greece to enable it to pay off old debts (or equivalently, to postponing debt servicing yet without cutting the present discounted value of debt servicing). The result was a massive rise in the debt-GDP ratio after 2008 that continues to hang ominously over Greece’s economic future.

Blunder 6. Leaving future growth to quantitative easing rather than public investments. Both the US and Europe cry out for upgraded and updated infrastructure. Genoa’s recent bridge collapse is a tragic manifestation of infrastructure that is woefully inadequate for the 21st century, especially in the era of global warming, with the burdens of rising sea levels, more droughts, more floods and more intense storms. Yet both the US and the EU have continued to pump up the economy through easy credits, which are highly vulnerable to another boom-bust cycle, rather than through long-term infrastructure investments. (Easy credits were the right policy immediately after the Lehman failure, but the growth package should have shifted from easy credits to increased public investments later on.)

Why did these blunders occur and why do they persist? Three main reasons.

First, our governments are notoriously short-sighted. At most they think to the next election; often, the tactics are much shorter-term than that. Yet the public infrastructure investments we need require serious planning, technical design and coalition building. Most importantly, they require a long-term vision. Boosting short-term liquidity is much easier, and of course much more vulnerable to yet another boom-bust cycle.

Second, our governments are notoriously local in politics. Greece needed and still needs long-term financial help from Germany mainly in the form of deep debt relief, yet too many German politicians such as former finance minister Wolfgang Schaeuble have burnished their domestic vote by bashing Greece rather than helping to end the crisis. The EU aims to be an inspiring union of Europe’s nations, yet the EU has a budget that is just 1 percent of the union’s combined national income. The result is a lack of fiscal solidarity within the EU, only cross-border finger pointing and blame.

Imagine for a moment if Germany’s oft-expressed horror at an EU “transfer union” were equally applied inside Germany. German society would collapse. In fact, Germany raises 45 percent of its own GDP as general government revenues to create a highly successful transfer union within Germany (also known as a “social market economy”). The EU will hold together only if the EU budget is enlarged to enable more cross-border transfers as part of economic solidarity and more European-wide public investment spending.

Third, the macroeconomics profession has also failed. At an analytical level, the two competing schools of macroeconomics, the Keynesians and the neoliberals, both got it wrong. The Keynesians treated the 2008 financial crisis as a crisis of aggregate demand rather than as a financial and structural crisis. They paid far too little attention to restoring lending by the banks, the adverse effects of Greece’s debt overhang and the need for increased investments in sustainable infrastructure. The neoliberals (like Weidmann) were far more damaging in their incorrect belief that market forces could quickly overcome the financial crisis and even resolve the overhang of debt.

Even worse, the macroeconomics profession generally stood on the sidelines as Greece suffered a persistent and catastrophic collapse of output deeper than the Great Depression. Until today, it has mostly nodded silently as Europe offered Greece one illusory “solution” after another. This includes the most recent package, which calls on Greece to make large debt service payments until 2060, with a primary budget surplus of 3.5 percent of GDP per year till 2022 and then an average of around 2 percent of GDP primary surplus until 2060. And even then, Greece would still be heavily indebted, with a debt-GDP ratio in 2060 of nearly 100 percent on the EU’s highly optimistic assumptions and perhaps 200 percent of GDP on more realistic assumptions!

It’s a travesty to call this new package a long-term solution for Greece.

In sifting through the mess of the past decade, I would like to pay high regard to George Papandreou and Yanis Varoufakis for trying to convince Greece’s European counterparts to agree on real solutions for Greece rather than mere temporizing measures. They showed resolve, talent and persistence, but alas they lacked willing counterparts. I give low marks to Jens Weidmann for his zealous market orthodoxy and Wolfgang Schaeuble for insisting on harsh fiscal policies in Greece that were designed more for local German politics than for Greece’s needs and Europe’s long-term interests.

Jeffrey Sachs is a professor and director of the Center for Sustainable Development at Columbia University.